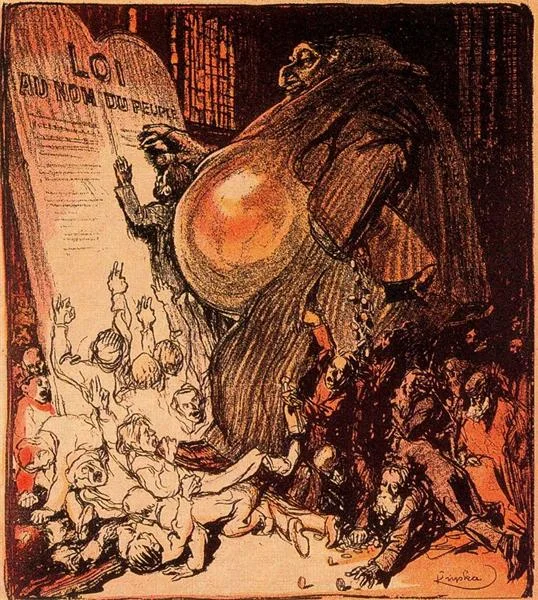

The unveiling of the Union Budget is one of the most anticipated annual economic rituals. The taxation policy is a tight rope - if fiscally imprudent, the exchequer will lack revenues; if over prudent, the exchequer will still lack revenues due to an increase in tax evasion. Given this important but precarious nature of the taxation policy, here is an analysis of the key taxation measures announced in the 2016-17 budget:

Reallocation of resources from urban to rural spaces

In response to the opposition’s allegations of the incumbent government being a ‘suit-boot ki sarkar’, the 2016-17 budget has made a marked shift in the collection of tax revenue from the rural to the urban population. 70% of the population living outside India’s mega cities will now be entitled to LPG, electricity, and irrigation at subsidized (i.e. a negative tax) rates. The shift in focus on rural India, especially agriculture, is perhaps desirable given the two-year drought, which has affected crop yields adversely. However, dealing with a drought-like situation requires provisional, counter-cyclical measures (such as an increase in minimum support price (MSP) when market collection is poor) - . Thus, the current policy measures do not adequately address concerns around the future of food security in India. Furthermore, provision of subsidies on a long term basis, as proposed by this budget, tends to have a detrimental effect on the environment. For example, irrigation subsidies encourage the farming of resource intensive crops which, in turn, results in an increase in use of fertilizers. In addition, irrigation subsidies may lead to the under-pricing of irrigated water and consequently, the overuse and inefficient use of water. The agricultural subsidies in conjunction with the uptake of genetically modified seeds (as indicated by Chief Economic Advisor, Dr. A. Subramanium in the Economic Survey) could potentially bring about the second green revolution, the sustainability of which is suspect. It must, however, be noted that to offset the adverse environmental effects of the same, the government has announced the purchase of 5 lakh acres of land for organic farming under the Parmparagat Krishi Vikas Yojna and has also allocated Rs.6,000 crore for recharging the ground water table.

The increased service tax on cellular service providers and eateries, imposition of a 0.5% Krishi Kalyan cess, an environmental cess of 1% on small CNG and LPG cars will result in a greater consumption tax burden on the urban population, the primary consumer of the aforementioned. This increased indirect tax burden (in conjunction with the removal of consumption subsidies for the rich) could potentially dampen consumer demand unless there is a commensurate increase in urban incomes or the aforementioned stimulus to rural India increases rural incomes, and thus, rural consumption correspondingly.

All that glitters…

The 1% increase in excise duty on gold is a crowd-pleasing one as the yellow metal is seen as a luxury good which does not fall in the consumption basket of the ‘Aam aadmi’. However, when juxtaposed against the fact that jewellery-making is the third largest source of employment in India (after agriculture and textile), especially for small and medium producers, such a measure will effectively eat into profits and therefore the incomes for those dependent on gold.

The triumph of prudence over populist

The Economic Survey cautioned against reducing income tax exemptions because such exemptions increase disposable income without affecting an actual increase in earned income. This increases the gap in tax collection, a front on which India already fares poorly as 85% of the economy remains outside the tax net (The Hindu). The budget has adhered to the same on two fronts: by not lowering the IT exemption slab and by announcing the phasing out of corporate tax exemptions. However, the proposed implementation of reduction in corporate taxes to offset the latter has been identified as a primary cause for income inequality in the sub-continent.

The curiosities

The reduction in the RnD subsidy from 200% to 150% seems suspect as that may affect the ability of Indian companies, especially pharmaceutical companies, to file for both product and process patents, which could potentially lead to an increase in prices of medical drugs.

The roll back of protectionist policies in the RnD industry can be contrasted against the announcement of protectionist policies in the industries associated with importing defence products. This curiosity, when looked at in tandem with the proposed increase in capital expenditure (which is greater than the increase in revenue expenditure), implies that the incumbent government intends to provide an impetus to domestic defence production under that Make in India scheme.

The demand of the RBI and SBI to raise the tax exemption limit on small savings deposits, which would have reduced the cost of funds for the banks and perhaps allowed for greater interest rate transmission, was not incorporated. This seems rather ironic as the current market expectation for an interest rate cut by the RBI given the availability of fiscal space accorded by setting the fiscal deficit at 3.5% will have limited impact on the real economy if banks, which are already stressed by NPAs, are unable to translate the same into lower lending rates.

Rolled back by popular demand

The move to rationalize EPF by according it similar treatment as other pension schemes was a fiscally prudent one but popular uproar against it has led to it being rolled back.

The budget, as always, was as much an economic exercise as a political one. While only time will tell whether this budget will be successful, it has already achieved the precarious balance of being called pro-poor and a market cheerer at the same time.

Kriti Mahajan